At some point in life, you may have heard of home insurance or home warranty, but you may not know the differences between them. These two terms are sometimes used interchangeably, but they are not the same thing. In this article, we will delve into the differences between home insurance and home warranty.

Contents

Home Insurance

Home insurance is a type of insurance that provides financial protection against any loss or damage to your home or personal belongings in your home. Home insurance policies usually cover damage caused by fire, theft, weather damage, and other perils.

There are three types of home insurance policies:

- HO-1: This policy provides limited coverage and is not commonly used.

- HO-2: This policy provides more coverage than the HO-1 policy and is the most commonly used policy.

- HO-3: This policy provides comprehensive coverage and is the most recommended policy.

Home insurance policies also cover personal liability protection. This means that if someone gets injured while on your property, the insurance company will cover any legal or medical costs.

Home Warranty

A home warranty is a service contract that provides repair and replacement coverage for home appliances and systems. Unlike home insurance, a home warranty does not cover damage caused by external factors such as fire or theft. Instead, it covers mechanical breakdowns or failures of appliances and systems due to normal wear and tear.

A home warranty typically covers the following items:

- Heating, ventilation, and air conditioning (HVAC) systems

- Electrical systems

- Plumbing systems

- Kitchen appliances

- Laundry appliances

A home warranty plan usually has a term of one year and can be renewed annually.

Key Differences

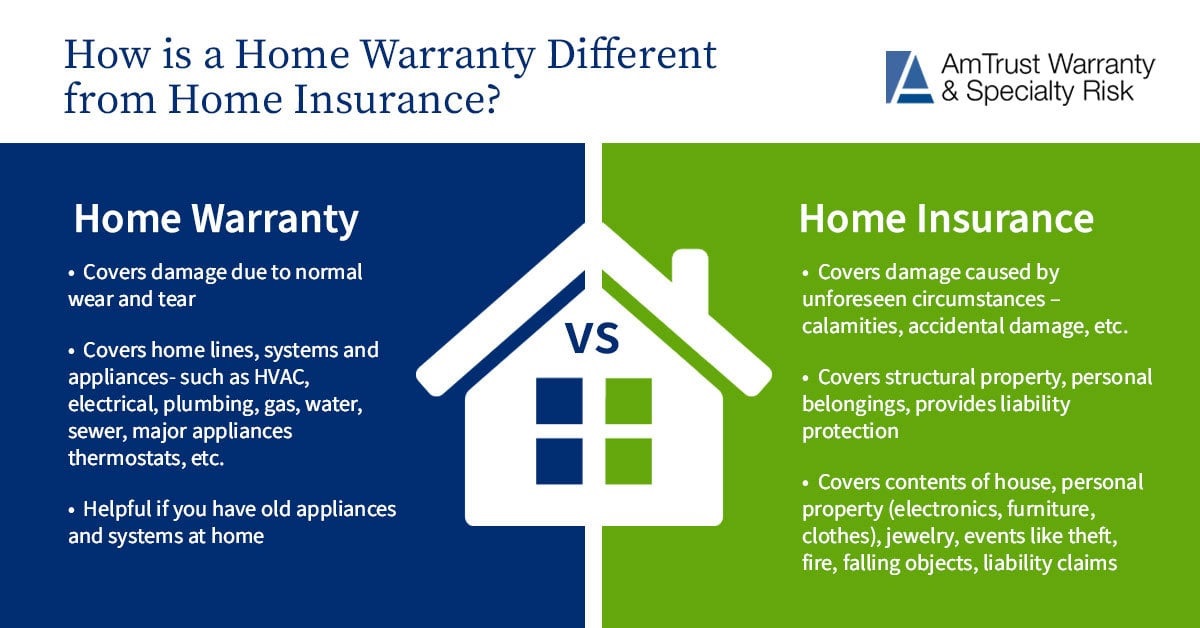

The key difference between home insurance and home warranty is the type of coverage they offer. Home insurance provides coverage for damage caused by external factors such as fire, theft, and weather damage, while a home warranty provides coverage for mechanical breakdowns or failures of appliances and systems due to normal wear and tear.

Another difference between home insurance and home warranty is the length of coverage. Home insurance policies typically last for one year and must be renewed annually. Home warranties usually last for one year but can be renewed annually.

Finally, home insurance and home warranty have different coverage limits. Home insurance policies usually have a limit on the amount of coverage provided for each type of damage, while home warranties usually have a limit on the amount of coverage provided per appliance or system.

Which One Do You Need?

Deciding between home insurance and home warranty depends on your needs. If you want financial protection against external factors such as fire, theft, and weather damage, then home insurance is the right choice for you. If you want coverage for home appliances and systems due to normal wear and tear, then a home warranty is the right choice for you.

However, it’s important to note that home insurance and home warranty are not mutually exclusive. You can have both types of coverage to ensure complete protection for your home and belongings.

Conclusion

In conclusion, home insurance and home warranty are two different types of coverage that offer protection for your home and belongings. Home insurance provides coverage for external factors such as fire, theft, and weather damage, while a home warranty provides coverage for mechanical breakdowns or failures of appliances and systems due to normal wear and tear.

Deciding which one to get depends on your needs, but it’s important to note that you can have both types of coverage for complete protection. We hope this article has helped you understand the differences between home insurance and home warranty.